|

Chase McBride was quoted in NPR's radio show entitled Monday's News Roundup for July 1, 2024 regarding the issue of ballet harvesting in Oklahoma.

Chase McBride has been selected to serve on the All Capital Bank Mayes County Advisory Board. Originally established in 1949 as the Bank of Locust Grove, All Capital Bank has proudly been serving the Locust Grove community in Mayes County, OK, for nearly 75 years. Being a small-town bank means focusing on the people and businesses in the community, and All Capital Bank strives to continue providing support for every customer as well as local schools and sports. The bank’s work in the past century has provided stability in an otherwise rocky economic environment. As the bank continues to grow and change to keep up with modern banking models, All Capital Bank is proud to continue providing the same quality of support and care for the community. To Learn more about All Capital Bank, see their webpage: All Capital Bank We had the privilege of successfully defending a candidate for Sheriff in front of the Delaware County Election Board this morning to remain on the ballot!

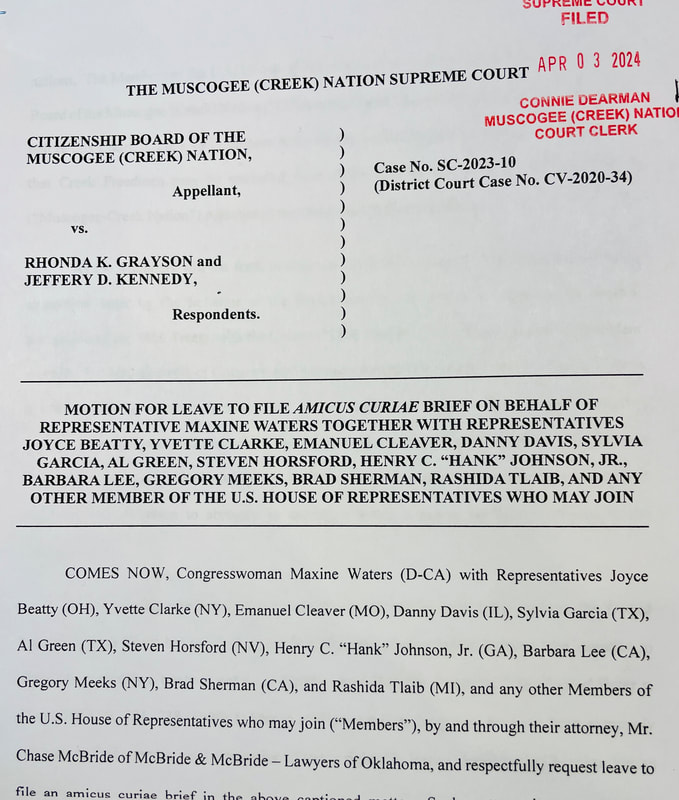

AMICUS BRIEF ON behalf of members of u.s. house of representatives in support of creek freedmen4/3/2024

Today our firm had the honor of formally requesting the Muscogee (Creek) Nation Supreme Court to allow us to file an Amicus Brief on behalf of our clients and members of the United States House of Representatives in support of Creek Freedman to receive citizenship.

We hope the Court will give us the opportunity to file a brief on our clients’ behalf and allow them to voice their support for the Creek Freedman that is backed by law. McBride & McBride Lawyers of Oklahoma represents 15 victims in the case and secured justice for those affected by the egregious actions that occurred at Salina High School.

For Full Article click here: Full Article |

Call Now: 918-825-3038 Categories |

RSS Feed

RSS Feed